Oklahoma Insurance Professionals LLC Blog |

|

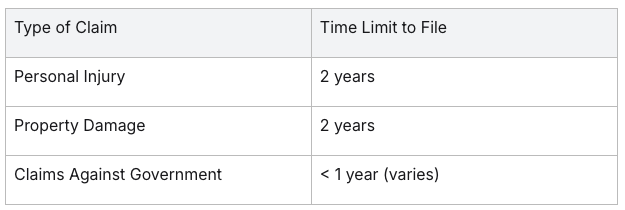

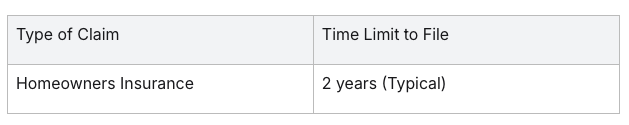

Oklahoma's turbulent weather can turn lives upside down overnight. When disaster strikes your home, understanding your insurance policy's fine print is crucial. Delayed action could mean forfeiting the aid you need to rebuild and recover. Let's explore the timeline for filing a homeowners insurance claim in the Sooner State. We'll guide you through the importance of timely filing, statutory deadlines, and practical steps to secure your financial relief after an unforeseen setback. Understanding the Importance of Timely FilingIn Oklahoma, the clock starts ticking immediately following an accident. It is crucial for those affected to be aware of the statute of limitations, the time limit within which they can file a claim for their losses. Whether it’s a personal injury claim or property damage, missing the filing deadline can result in the loss of the right to seek compensation. For most personal injury claims, such as those stemming from vehicular accidents or slips and falls, the injured party has a two-year time limit to file a lawsuit against the fault party. Precisely, you must take legal action within this period, starting from the date of the injury or accident. Here's a simplified breakdown: If you're engaging in settlement negotiations with an insurance company or waiting for your 18th birthday to lodge a personal injury lawsuit, be wary of the deadlines. After severe injury, contact personal injury attorneys in Oklahoma City promptly to navigate through the complexities like the discovery rule, which might extend these deadlines under specific circumstances. They will ensure the insurance adjuster and insurance company are managed effectively, and that you secure compensation for damages before the limitations filing deadline passes. The Statute of Limitations for Homeowners Insurance ClaimsWhen dealing with homeowners insurance claims in Oklahoma, it's essential to understand that there is a statute of limitations that dictates the timeframe within which you must file a claim. This statutory time limit exists to ensure that claims are made while evidence is still fresh and to provide a degree of certainty for both the homeowner and the insurance company. The time limit for filing a claim can vary depending on the specific circumstances of your case and the type of insurance policy you hold. In general, homeowners should review their insurance policy documents as these will typically specify the timeframe for filing a claim after an incident has occurred. It's crucial not to delay and to notify your insurance company as soon as possible to avoid any potential disputes over the timing of your claim. Two-Year Time Limit for Filing a ClaimFor most insurance claims in Oklahoma, including those related to homeowners insurance, policyholders often have a two-year time limit to file a claim. This means from the date of the damage or loss, you have two years to undertake legal action against the insurance company if necessary. It's imperative to begin the claims process with your insurance adjuster promptly to ensure you do not overlook this critical deadline. Keep in mind that the actual process of filing an insurance claim should be initiated well before this two-year cutoff to allow time for the insurance adjuster to assess the damage, process your claim, and for any potential settlement negotiations. If you suspect any delays or complications, reaching out to an insurance claim attorney may help streamline the process. Exceptions to the Two-Year Time LimitWhile the typical time limit to file a homeowners insurance claim is two years in Oklahoma, several exceptions can affect this period. Understanding these exceptions is important as they can either shorten or extend the time you have to file a claim.

Steps to Take After an IncidentAfter a distressing incident like property damage, taking immediate and appropriate steps is the key to ensuring a smooth claims process and securing the compensation you deserve. While the aftermath can be overwhelming, here's a structured approach to help you navigate the initial chaos:

Oklahoma Insurance Pros Can HelpOklahoma Insurance Professionals exists as an independent insurance agency right here in Oklahoma City to help our neighbors with home, auto, life, and business insurance. By living and working here, we know the ins and outs of insurance and the unique challenges Oklahomans face. That's why we serve to bring both the best coverage at the best value to you to make life a little more secure. Let's take a look at your current insurance policy (or policies) and make sure you have proper insurance coverage.

0 Comments

Leave a Reply. |

Contact Us(405) 838-1818 Archives

March 2024

Categories

All

|

Navigation |

Connect With UsShare This Page |

Contact UsOklahoma Insurance Professionals LLC

1624 SW 122nd St Oklahoma City, OK 73170 (405) 838-1818 Click Here to Email Us |

Location |

RSS Feed

RSS Feed